US Economy Confronts Stagflation Risks as Tariff Pressures Mount

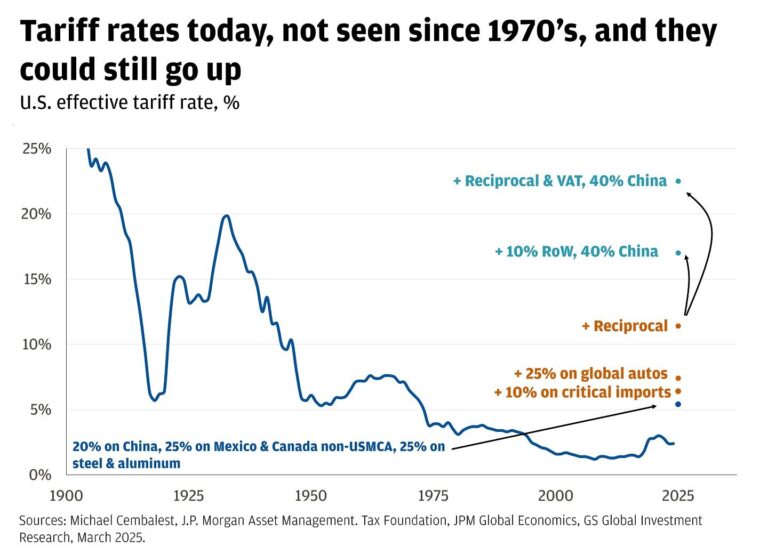

JPMorgan’s recent economic forecast signals a daunting outlook for the United States in 2025, warning of a stagflationary environment where sluggish growth coincides with persistent inflation. This rare economic condition is largely attributed to the ongoing escalation of tariffs, which continue to inflate costs for both producers and consumers. The resulting squeeze on profit margins and disposable income is expected to dampen consumer sentiment and restrain business investments, creating a challenging landscape for economic policymakers.

Several critical elements underpin this forecasted slowdown:

- Escalating input expenses: Tariffs increase the cost of essential raw materials and components,disrupting supply chains.

- Declining trade activity: Heightened trade barriers reduce export and import volumes, limiting access to global markets.

- Persistent inflationary trends: Elevated production costs translate into higher retail prices, eroding purchasing power.

- Monetary policy limitations: Elevated inflation restricts the Federal Reserve’s ability to stimulate growth through interest rate reductions.

| Economic Indicator | 2024 Estimate | 2025 Forecast |

|---|---|---|

| GDP Growth | 2.1% | 0.7% |

| Inflation Rate | 3.4% | 4.2% |

| Unemployment Rate | 3.6% | 4.8% |

Tariffs Amplify Stagflation Risks in the US Economy by 2025

According to JPMorgan’s in-depth analysis, the US economy is poised to encounter a stagflationary phase driven by sustained tariff increases. This scenario, marked by stagnant economic output alongside rising inflation, presents a formidable challenge. The bank emphasizes that ongoing tariff hikes on imports are inflating consumer prices while compressing corporate profit margins, which in turn curtails investment and slows economic momentum.

Key contributors to this outlook include:

- Extended tariff escalations with major trade partners, disrupting manufacturing costs and supply chain stability.

- Decelerating productivity growth that limits the economy’s expansion potential.

- Enduring inflationary pressures that diminish consumer buying power.

| Economic Indicator | 2025 Projection | Implications |

|---|---|---|

| GDP Growth | 1.2% | Below long-term average, indicating stagnation |

| Inflation Rate | 4.5% | High inflation constrains consumer spending |

| Unemployment Rate | 5.5% | Increasing slack in the labor market |

Policy Approaches to Combat Inflation and Support Economic Growth

To mitigate the anticipated economic deceleration fueled by tariff-induced inflation, a extensive policy response is essential. Monetary authorities must carefully calibrate interest rate adjustments to temper inflation without undermining investment and growth. Simultaneously, fiscal measures should focus on providing targeted assistance to industries disproportionately affected by rising import costs, helping maintain their competitiveness amid escalating expenses.

Strengthening supply chain resilience through investments in domestic production capabilities and infrastructure modernization is critical. By reducing reliance on vulnerable foreign supply sources, the economy can better withstand external shocks and stabilize price fluctuations.Furthermore, promoting innovation and workforce skill development will enhance productivity, offsetting the adverse effects of tariff-related cost increases and fostering enduring economic momentum.

- Measured interest rate hikes to balance inflation control with growth support

- Targeted fiscal relief for sectors heavily impacted by import tariffs

- Investment in supply chain infrastructure to reduce external dependencies

- Encouragement of innovation and workforce training to boost productivity

| Policy Area | Immediate Effect | Long-Term Outcome |

|---|---|---|

| Monetary Policy | Inflation moderation | Sustained economic stability |

| Fiscal Support | Relief for affected sectors | Restored industrial competitiveness |

| Supply Chain Investment | Reduced vulnerability | Enhanced economic resilience |

| Innovation & Training | Improved workforce capabilities | Increased productivity and growth |

Investment Strategies to Navigate a Stagflationary Market

With the prospect of stagflation looming due to tariff-driven inflation and sluggish growth, investors are advised to reassess their portfolios to withstand this complex economic environment.JPMorgan’s insights suggest that the combination of rising import costs and weakened consumer demand will likely suppress economic momentum in 2025, creating volatility across asset classes. Diversification and strategic asset allocation will be key to managing risks and capitalizing on opportunities in this uncertain landscape.

- Emphasize tangible assets: Commodities and real estate often serve as effective hedges against inflation during periods of economic stagnation.

- Utilize inflation-protected instruments: Treasury Inflation-Protected Securities (TIPS) and similar products can safeguard fixed-income investments from inflation erosion.

- Prioritize high-quality equities: Companies with robust pricing power and stable cash flows are better positioned to endure margin pressures and demand fluctuations.

| Asset Category | Stagflation Outlook | Recommended Approach |

|---|---|---|

| Equities | Sector-specific volatility expected | Focus on consumer staples and utilities |

| Bonds | Yield compression with inflation risk | Increase allocation to TIPS |

| Real Assets | Effective inflation hedge potential | Invest in commodities and real estate |

Conclusion: Critical Insights on the US Economic Outlook for 2025

JPMorgan’s projection of a tariff-induced stagflationary slowdown in 2025 underscores the complex challenges facing the US economy. The simultaneous pressures of persistent inflation and subdued growth demand nuanced policy responses and strategic market positioning. As the nation approaches this uncertain period, close attention to trade policies, inflation trends, and economic indicators will be vital for policymakers, investors, and businesses aiming to navigate the evolving landscape effectively.