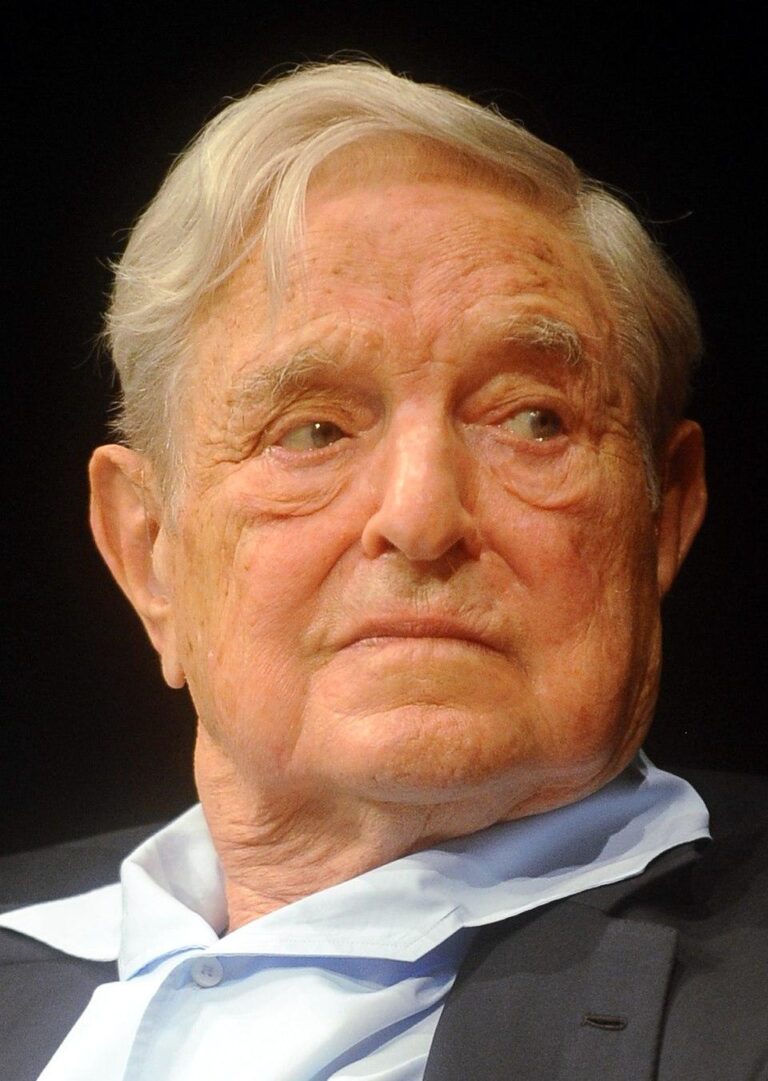

Reevaluating George Soros’s Recent Investment Setbacks: Insights and Market Consequences

Understanding the Missteps in Soros’s Latest Financial Moves

George Soros, renowned for his sharp financial acumen and historic market maneuvers such as the 1992 pound sterling short, has recently encountered significant challenges with his investment portfolio. His recent focus on emerging technology equities, despite clear economic signals warning of increased market instability, has led to notable losses. This divergence from prevailing market trends has not only diminished his portfolio’s value but also sparked widespread discussion about the vulnerabilities even elite investors face.

Market analysts emphasize several key repercussions stemming from this high-profile miscalculation:

- Shift in Investor Behavior: A growing preference for diversified holdings over concentrated,high-risk positions.

- Enhanced Risk Management: Hedge funds and financial institutions are likely to tighten risk protocols to prevent similar setbacks.

- Reassessment of Financial Icons: The episode highlights the necessity for investors to critically evaluate strategies, regardless of the investor’s stature.

| Investment Aspect | Anticipated Outcome | Realized Outcome |

|---|---|---|

| Tech Sector Performance | Robust Expansion | Significant Downturn |

| Portfolio Consistency | Stable Returns | High Volatility |

| Investor Trust | Increased Confidence | Declined Confidence |

Global Market Repercussions and Political Ramifications

Soros’s investment activities have historically influenced global financial markets, but his recent errors reveal the fragility of relying heavily on individual market influencers. The volatility in commodities, foreign exchange rates, and government bonds has intensified as market participants reassess their exposure to positions linked with Soros’s strategies. This phenomenon underscores that even investors with vast capital are susceptible to the unpredictable nature of international markets.

Beyond finance, Soros’s extensive political involvement through philanthropic funding of progressive causes has met increasing resistance. Several nations, concerned about external influence on domestic affairs, have responded with stricter regulations and public campaigns aimed at curbing what they perceive as foreign interference. This evolving landscape reflects a broader trend where:

- National governments reinforce control over financial transactions and non-governmental organizations.

- Developing economies resist perceived pressures linked to Western political agendas.

- Financial entities exercise caution in dealings with politically active investors.

| Area of Impact | Prior to Recent Developments | Following Recent Developments |

|---|---|---|

| Market Stability | Moderate Fluctuations | Heightened Volatility |

| Political Clout | Widespread Acceptance | Growing Skepticism |

| Investment Behavior | Encouraged Risk-Taking | Increased Risk Aversion |

Key Takeaways from Soros’s Investment Challenges

While George Soros is frequently enough celebrated for his monumental financial victories, his recent setbacks provide critical lessons for investors. One major insight is the peril of contrarian bets without a well-defined exit strategy, especially when such positions contradict broader economic signals. These miscalculations highlight how even the most elegant approaches can falter amid unforeseen geopolitical or economic shifts.

Additionally, Soros’s experience illustrates the impact of cognitive biases and emotional investment in a particular thesis, which can delay necessary corrective actions and exacerbate losses.From this, investors can extract several important principles:

- Diversification: Spreading risk to cushion against unexpected market reversals.

- Adaptability: Remaining flexible and responsive to changing market conditions.

- Market Awareness: Recognizing when to adjust or exit positions to safeguard capital.

| Strategic Component | Challenges Faced | Lesson for Investors |

|---|---|---|

| Timing the Market | Incorrect anticipation of economic reversals | Exercise caution during extreme market sentiment |

| Leverage Submission | Excessive exposure magnified losses | Limit leverage and prepare for volatility |

| Emotional Control | Delayed withdrawal from losing positions | Implement strict stop-loss protocols |

Guidance for Investors Engaging in High-Risk Markets

For those navigating speculative investment landscapes, decisions must be grounded in complete analysis rather than impulsive reactions or market hype. Maintaining a well-diversified portfolio is essential to buffer against the inherent risks of volatile sectors. Recommended approaches include:

- Defining precise entry and exit criteria based on detailed market evaluation.

- Employing stop-loss mechanisms to cap potential losses.

- Keeping a close watch on macroeconomic trends that may signal shifts in investor sentiment.

Equally important is sustaining emotional discipline during turbulent market phases. The temptation of rapid profits can impair objective decision-making,leading to precarious exposures. To mitigate these risks, consider the following framework:

| Risk Element | Mitigation Strategy |

|---|---|

| Market Overextension | Regular portfolio rebalancing |

| Following the Crowd | Autonomous, data-driven analysis |

| Unexpected Geopolitical Shocks | Maintaining adequate liquidity reserves |

Final Reflections

George Soros’s recent investment setbacks, as highlighted in City Journal, serve as a powerful reminder of the inherent uncertainties in financial markets. Despite his storied history of success, this episode reveals the risks embedded in speculative ventures and the complex interplay of timing, strategy, and global economic forces. As the investment community continues to analyze these developments, Soros’s experience offers enduring lessons on prudence, adaptability, and the limits of even the most celebrated financial expertise.