Tariff-Induced Decline in Cargo Throughput at the Port of Los Angeles: Challenges and Responses

How New Tariffs Have Reshaped Cargo Flow at the Port of Los Angeles

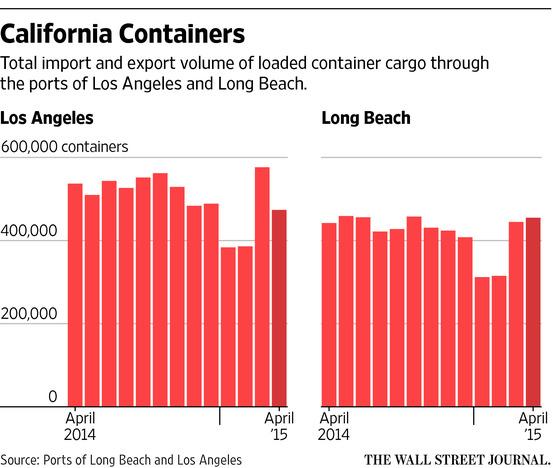

Following the recent enforcement of additional tariffs, the Port of Los Angeles‚ÄĒone of the busiest maritime gateways in the United States‚ÄĒhas experienced a dramatic 35% reduction in cargo throughput. This downturn reflects a meaningful shift in trade dynamics as importers and exporters adjust to increased costs and regulatory complexities. Industry analysts emphasize that this contraction is symptomatic of wider disruptions affecting supply chains, freight expenses, and inventory strategies nationwide.

Primary contributors to this decline include:

- Interruptions in supply chains leading to shipment delays and congestion

- Escalating operational expenses prompting rerouting of shipments to less impacted ports

- Decreased consumer purchasing power due to tariff-driven price increases on imported products

- Businesses reducing stock levels amid uncertainty about future trade policies

| Month | Cargo Volume (TEUs) | Percentage Change |

|---|---|---|

| January 2024 | 850,000 | ‚ÄĒ |

| April 2024 | 552,500 | -35% |

Broader Economic Impacts on Regional and Global Supply Networks

The tariff measures have not only disrupted local port operations but have also sent shockwaves through global supply chains. The Port of Los Angeles, once a thriving nexus for international trade, now faces a steep decline in container traffic, which reverberates through manufacturing and retail sectors dependent on timely imports and exports. Companies are contending with increased tariffs that complicate procurement and distribution, resulting in longer lead times and a pivot toward alternative sourcing.

On a global scale, these challenges manifest as increased logistics costs and strained trade alliances. Key issues reported by industry leaders include:

- Higher operational expenditures: Carriers and freight forwarders are transferring tariff-related costs to end consumers, squeezing profit margins.

- Inventory volatility: Warehouses face either surplus stock or shortages due to unpredictable supply flows.

- Shift in trade patterns: Accelerated movement toward regional suppliers to reduce exposure to tariff risks.

| Metric | Pre-Tariff | Post-Tariff |

|---|---|---|

| Port of LA Cargo Volume | 100% | 65% |

| Average Shipping Cost | $1,200 | $1,600 |

| Average Lead Time (Days) | 20 | 30+ |

Initiatives to Reverse the Downtrend in Port Throughput

In response to the significant drop in cargo volumes, port management is prioritizing operational enhancements and strategic collaborations. Investments are being funneled into upgrading infrastructure with cutting-edge automation and digital tools designed to accelerate cargo processing and minimize vessel turnaround times. Moreover, the port is strengthening partnerships with shipping lines and inland transport providers to improve coordination and alleviate congestion caused by tariff-related market shifts.

Highlighted strategies include:

- Adaptive Scheduling: Implementing flexible berth assignments to maximize dock utilization during varying traffic periods.

- Expanding Cargo Diversity: Targeting new trade corridors and broadening the range of goods handled to reduce reliance on tariff-affected sectors.

- Collaborative Engagement: Ongoing dialog with local enterprises and government bodies to align port growth with regional economic objectives.

| Initiative | Anticipated Benefit | Implementation Timeline |

|---|---|---|

| Automation Enhancements | Accelerated cargo handling | Q3 2024 |

| New Trade Alliances | Broadened cargo portfolio | Q4 2024 |

| Optimized Scheduling | Reduced vessel wait times | Ongoing |

Policy Measures to Enhance Port Resilience and Stimulate Trade Recovery

To halt the ongoing decline in cargo throughput and strengthen the Port of Los Angeles against future disruptions, policymakers must implement focused strategies that enhance operational capacity and global competitiveness. Priorities include expanding infrastructure to ease congestion, streamlining customs processes to expedite cargo clearance, and fostering robust collaboration between port authorities and maritime stakeholders. Additionally, diversifying international trade partnerships can reduce vulnerability to tariff shocks, ensuring steady cargo flows and safeguarding regional employment.

- Accelerate adoption of digital port technologies for improved cargo tracking and reduced delays.

- Develop flexible tariff frameworks that encourage balanced import-export activities and adapt to global market changes.

- Invest in workforce development to boost productivity and prepare labor for technological advancements.

- Promote public-private partnerships to share costs and risks associated with modernization efforts.

| Policy Focus | Recommended Action | Expected Impact |

|---|---|---|

| Infrastructure | Increase container handling capacity | Reduced congestion and faster turnaround |

| Customs | Streamline clearance procedures | Improved cargo flow and throughput |

| Trade Relations | Expand export market diversity | Lower dependency and enhanced resilience |

| Technology | Implement automated tracking systems | Greater openness and efficiency |

Looking Ahead: Navigating the Future of Trade at the Port of Los Angeles

As the Port of Los Angeles contends with a 35% drop in cargo volumes amid persistent tariff pressures, the consequences ripple through supply chains and local economies alike. Stakeholders remain vigilant, continuously assessing trade policies and adopting adaptive measures to minimize disruption. This evolving landscape highlights the intricate interplay between international trade regulations and port operations, underscoring the necessity for balanced policies that foster economic growth while promoting equitable trade practices.