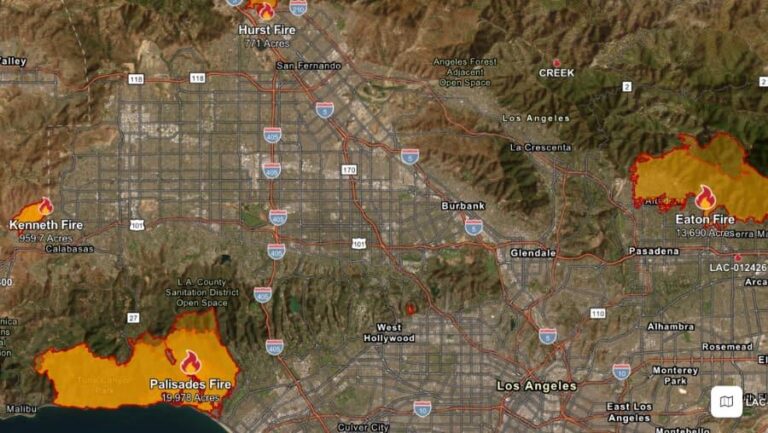

Los Angeles Wildfires Highlight Critical Insurance Industry Challenges

Insurance Coverage Gaps Revealed by Recent Wildfire Disasters

The recent spate of wildfires in the Los Angeles area has brought to light notable weaknesses in how the insurance sector handles catastrophic wildfire losses. Many homeowners are discovering that their policies do not fully cover the extensive costs associated with fire damage, including rebuilding expenses and temporary relocation.Elaborate claims procedures and payout limits that fail to match actual losses have left many policyholders financially vulnerable.These issues have compelled insurers to revisit their risk evaluation frameworks and premium pricing, especially as wildfire events grow more frequent and intense due to climate change. Experts caution that without rapid innovation, both insurers and insured individuals may face prolonged financial and operational difficulties.

The main challenges confronting the insurance market include:

- Inadequate wildfire risk modeling: Customary actuarial approaches have not fully captured the increasing severity and frequency of fires.

- Policy exclusions and coverage gaps: Many standard insurance contracts exclude essential services such as debris cleanup and temporary housing support.

- Escalating premiums and deductibles: Rising costs are making insurance unaffordable for many homeowners in high-risk zones.

| Issue | Effect |

|---|---|

| Risk Evaluation | Outdated models underestimate wildfire exposure |

| Policy Coverage | Common exclusions limit claim eligibility |

| Claims Handling | Prolonged processing times increase financial strain |

| Premium Trends | Sharp increases reduce insurance accessibility |

Surge in Claims and Payouts Threatens Insurer Profitability

The escalation of wildfire incidents in Los Angeles has led to a dramatic rise in insurance claims, putting immense pressure on the financial health of insurance providers. Both the number and severity of claims have surged, eroding profit margins and exposing the limitations of traditional risk models based on historical fire data. These models are no longer sufficient in the face of prolonged fire seasons and increasingly destructive blazes, prompting insurers to overhaul their risk assessments and pricing methodologies.

Contributing factors intensifying this challenge include:

- Longer fire seasons extending risk exposure periods

- Higher property valuations increasing claim amounts

- Rising reconstruction costs exacerbated by supply chain disruptions

Industry analysts warn that without adopting innovative underwriting and risk management strategies, insurers may be forced to implement steep premium hikes, restrict coverage, or withdraw from markets most affected by wildfires.

| Metric | 2019 | 2023 | Change |

|---|---|---|---|

| Claims Filed | 12,400 | 31,200 | +152% |

| Total Payouts ($ millions) | 950 | 2,750 | +189% |

| Profit Margin (%) | 7.8 | 1.9 | -5.9 pts |

Emerging Technologies and Strategies for Enhanced Wildfire Risk Management

The intensifying wildfire threat in Los Angeles has accelerated the insurance industry’s shift toward advanced risk assessment and mitigation techniques. Insurers are increasingly leveraging artificial intelligence-powered predictive analytics and real-time satellite surveillance to better forecast fire behavior and improve underwriting accuracy. These technological advancements enable more precise identification of high-risk areas and facilitate quicker emergency responses. Collaborative efforts among insurers, government agencies, and technology companies are fostering a dynamic habitat for sharing critical data, which is essential for both pre-disaster risk reduction and efficient post-disaster recovery.

A extensive, multi-pronged approach is now vital for insurers aiming to maintain market presence amid frequent, severe wildfire events.Key focus areas include:

- Refined Geographic Risk Analysis: Utilizing detailed microclimate and vegetation data to pinpoint zones with elevated fire susceptibility.

- Adaptive Policy Frameworks: Implementing flexible premium structures that adjust in near real-time based on evolving fire risks and community resilience.

- Engagement with Homeowners: Offering incentives such as premium discounts and grants to encourage fire-resistant home upgrades.

| Innovation | Advantage | Implementation Status |

|---|---|---|

| AI-Based Predictive Models | Enhanced accuracy in loss forecasting | Pilot programs underway |

| Satellite Monitoring Systems | Accelerated emergency detection and response | Fully operational |

| Dynamic Premium Pricing | Risk-reflective insurance costs | Under evaluation |

Strategic Recommendations for Insurers to Bolster Wildfire Resilience

To effectively address the growing wildfire threat, insurance companies must integrate state-of-the-art risk evaluation tools that combine real-time environmental monitoring with elegant predictive analytics. Employing satellite imagery, AI-driven fire behavior models, and comprehensive historical data allows for more accurate underwriting and risk pricing. Additionally, forging strong partnerships with local authorities and wildfire mitigation organizations can enhance community-level preparedness, reducing both the frequency and severity of claims.

Strengthening resilience also requires updating policy designs to reflect the evolving wildfire landscape. Recommended best practices include:

- Customizable coverage options tailored to the specific risks of high-fire-hazard areas

- Incentive programs encouraging homeowners to adopt fire-resistant building materials and landscaping

- Streamlined digital claims processing to expedite settlements and improve customer experience

- Investment in early warning and loss prevention technologies such as smart sensors and automated alerts

| Core Strategy | Expected Benefit |

|---|---|

| Predictive Fire Risk Analytics | More precise risk-based pricing |

| Policyholder Mitigation Incentives | Lower claim frequency and severity |

| Digital Claims Platforms | Faster claim resolution and improved satisfaction |

| Collaborative Community Programs | Shared resources and enhanced risk reduction |

Final Thoughts: Navigating the Future of Wildfire Insurance in Los Angeles

As wildfires continue to devastate Los Angeles communities and infrastructure, the insurance industry confronts mounting financial and operational challenges. The surge in claims and the need for more sophisticated risk assessments demand swift adaptation from insurers to support recovery efforts and ensure sustainable coverage in wildfire-prone regions. This evolving crisis highlights the critical importance of collaborative initiatives among insurers, regulators, policymakers, and communities to build resilience and safeguard both residents and businesses against future wildfire catastrophes.