Wildfire Claims Shake the US Insurance Market

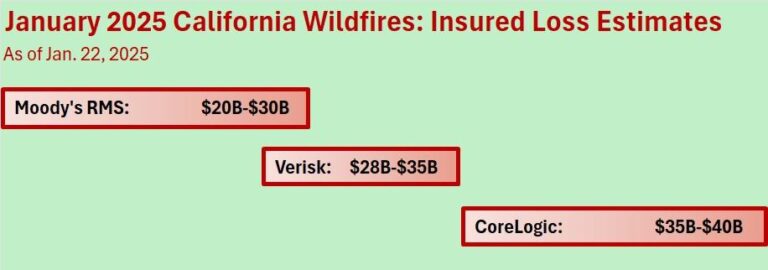

The recent wildfires ravaging Los Angeles have inflicted a profound financial toll on the American insurance sector, with preliminary loss projections reaching an astonishing $20 billion. This figure ranks among the highest wildfire-related insurance payouts recorded,significantly denting the profitability of major insurers. In response to the surge in claims,stock valuations of leading insurance companies have experienced sharp declines,signaling investor unease about the escalating wildfire threat and the industry’s capacity to manage such large-scale disasters.

Industry specialists highlight that this catastrophe exposes critical weaknesses in existing underwriting frameworks and risk evaluation methods. Key consequences emerging from this event include:

- Rising insurance premiums for homeowners in wildfire-vulnerable zones

- Reassessment of policy coverage limits and the introduction of new exclusions

- Intensified oversight by state insurance regulators

As insurers confront ballooning claims costs, the wildfire crisis is set to transform insurance protocols, impacting both consumers and businesses across California and nationwide.

| Insurance Provider | Projected Losses ($B) | Stock Price Change (%) |

|---|---|---|

| Alpha Insurance | 5.4 | -13 |

| Delta Mutual | 8.1 | -16 |

| Continental Re | 3.2 | -10 |

Market Reactions and Investor Concerns Following Los Angeles Wildfires

The devastating wildfires in Los Angeles have sent shockwaves through the insurance industry, with loss estimates hitting an unprecedented $20 billion. This massive financial burden has unsettled investors,triggering a notable downturn in insurance stock prices as confidence in the sectorŌĆÖs resilience diminishes. Analysts caution that the widespread destruction of residential and commercial properties will likely drive premium hikes and stricter underwriting criteria across the board.

Investor sentiment is increasingly influenced by several factors:

- Growing awareness of climate changeŌĆÖs role in intensifying wildfire frequency and severity

- Potential bottlenecks in claims processing due to insurer overload

- Heightened regulatory focus on insurer solvency and capital adequacy

| Insurance Sector Indicator | Current Data |

|---|---|

| Stock Price Decline | 9-14% |

| Number of Claims Filed | Over 520,000 |

| Average Premium Increase | 16-20% |

Economic and Insurance Sector Implications of Wildfire Losses

The projected $20 billion loss from the Los Angeles wildfires represents a severe setback for the insurance industry,precipitating meaningful stock price drops among top US insurers. Experts warn that this enormous payout will erode underwriting profits for the current fiscal year and necessitate a extensive reevaluation of risk exposure in wildfire-prone areas. As insurers allocate substantial capital to cover claims,investors remain cautious about the long-term consequences,including more conservative underwriting and premium adjustments.

Wider economic repercussions extend beyond the insurance domain. The wildfire devastation disrupts local economies by depressing real estate values, slowing construction projects, and curbing consumer spending in affected communities. Economists express concern over:

- Escalating insurance costs burdening homeowners and businesses

- Increased public expenditure on disaster relief and infrastructure rebuilding

- Potential knock-on effects on mortgage lending and property markets

| Sector | Immediate Impact | Long-Term Projection |

|---|---|---|

| Insurance Industry | Profit margins shrink within 12 months | Premium hikes and refined risk models |

| Housing Market | Local property value declines | Market adjustments in wildfire-prone areas |

| Regional Economy | Business disruptions and job losses | Recovery efforts and infrastructure upgrades |

Proactive Strategies for Wildfire Risk Reduction and Resilience

Given the enormous $20 billion loss estimate from the Los Angeles wildfires, it is imperative for insurers and policymakers to intensify joint initiatives aimed at bolstering community resilience and enhancing risk mitigation. Insurance companies should leverage advanced data analytics and satellite surveillance technologies to improve wildfire forecasting and refine underwriting criteria. Concurrently, government bodies must prioritize investments in defensible space programs and infrastructure improvements, such as controlled burns and fire-resistant construction standards, to mitigate future wildfire damage.

Comprehensive wildfire preparedness also hinges on robust public education campaigns that stress evacuation readiness and real-time communication. Essential measures include:

- Strengthening inter-agency communication: Establish integrated platforms connecting insurers, emergency services, and residents.

- Implementing landscape-scale vegetation management: Partner with environmental scientists and forestry experts to reduce fuel loads and fire intensity.

- Encouraging fire-resilient rebuilding: Offer financial incentives and regulatory support for retrofitting homes with fire-resistant materials and designs.

| Initiative | Lead Organization | Anticipated Benefit |

|---|---|---|

| Enhanced Risk Modeling | Insurance Providers | More accurate underwriting and loss prediction |

| Defensible Space Enforcement | Local Authorities | Lowered property exposure to wildfires |

| Fuel Reduction Programs | Forestry Agencies | Decreased wildfire severity and spread |

| Public Awareness Campaigns | Emergency Management | Improved community preparedness and safety |

Conclusion

As the Los Angeles wildfire loss estimates continue to escalate, the US insurance industry confronts mounting financial challenges that highlight the intensifying risks posed by climate-related disasters. Market participants will be closely watching upcoming earnings reports to gauge the full extent of the impact. With billions in claims anticipated, insurers must revisit their risk assessment models and preparedness strategies to effectively navigate an era marked by increasingly frequent and severe natural catastrophes.